Credit Union Cheyenne: Exceptional Member Advantages and Solutions

Credit Union Cheyenne: Exceptional Member Advantages and Solutions

Blog Article

Experience the Distinction With Credit Report Unions

:max_bytes(150000):strip_icc()/GettyImages-184268471-5bcba6ad46e0fb0051ae6958.jpg)

Membership Benefits

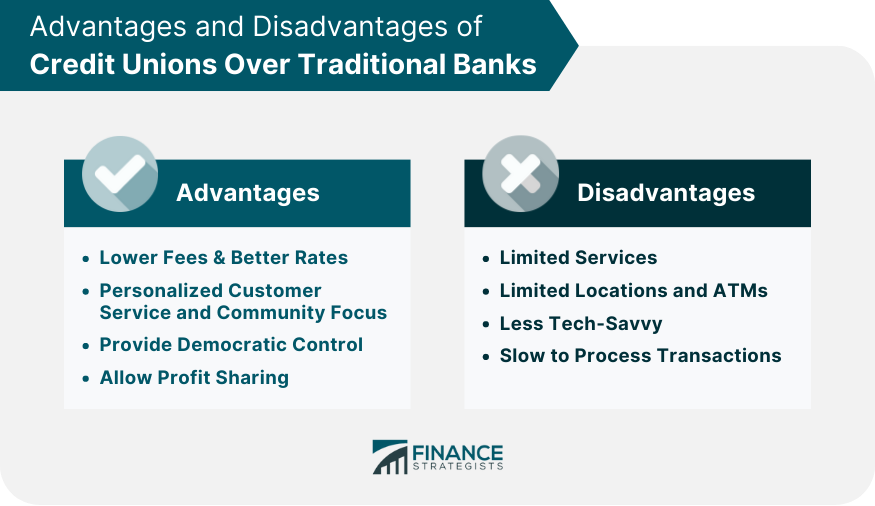

Credit unions use a variety of useful advantages to their members, distinguishing themselves from conventional banks. Unlike banks, credit history unions are possessed by their participants, that also have voting rights to choose the board of supervisors.

Another significant advantage of credit history unions is their concentrate on neighborhood participation and support. Several lending institution actively take part in neighborhood advancement jobs, economic education programs, and charitable initiatives. By promoting a strong feeling of neighborhood, credit history unions not only offer monetary solutions but likewise add to the overall health and success of the communities they offer.

In addition, lending institution prioritize economic education and learning and empowerment (Wyoming Credit Unions). They use resources and assistance to help participants make informed decisions concerning their funds, enhance their credit history, and achieve their long-lasting economic goals. This commitment to education sets cooperative credit union apart as relied on economic companions dedicated to the financial well-being of their participants

Personalized Customer Service

Providing customized assistance and personalized interest, credit unions stand out in providing individualized client service to their members. Unlike standard financial institutions, cooperative credit union prioritize developing solid relationships with their members, concentrating on understanding their monetary goals and one-of-a-kind requirements. When a participant communicates with a cooperative credit union, they can expect to be dealt with as a valued person rather than simply an account number.

Cooperative credit union usually have local branches that permit for in person communications, improving the individual touch in client service. Members can speak directly with educated staff who are dedicated to assisting them browse monetary decisions, whether it's opening a new account, obtaining a lending, or seeking advice on handling their finances. This personalized method sets cooperative credit union apart, as members feel sustained and empowered in accomplishing their monetary purposes.

Additionally, credit scores unions additionally offer convenient electronic banking solutions without jeopardizing the individual connection. Participants can access their accounts online or via mobile applications while still receiving the exact same degree of personalized assistance and treatment.

Competitive Rate Of Interest

When seeking economic products, members of credit scores unions gain from competitive rate of interest that can improve their financial savings and obtaining chances. Lending institution, as not-for-profit economic establishments, often supply more favorable rate of interest contrasted to standard financial institutions. These competitive rates can relate to various economic items such as savings accounts, certificates of deposit (CDs), personal financings, mortgages, and charge card.

Among the essential benefits of lending institution is their focus on offering participants instead of making the most of profits. This member-centric method permits lending institution to prioritize supplying lower rates of interest on financings and higher interest prices on financial savings accounts, offering participants with the possibility to expand their cash better.

Furthermore, credit score unions are recognized for their readiness to deal with members who may have less-than-perfect credit report. In spite of this, lending institution still make every effort to maintain competitive rate of interest rates, guaranteeing that all members have accessibility to inexpensive monetary options. By making the most of these competitive rate of interest, lending institution participants can take advantage of their funds and accomplish their savings and obtaining goals more efficiently.

Lower Costs and charges

One remarkable feature of lending institution is their dedication to decreasing costs and prices for their members. Unlike traditional financial institutions that frequently prioritize taking full advantage of profits, debt unions run as not-for-profit companies, allowing her comment is here them to supply much more beneficial terms to their members. This difference in structure converts to decrease charges and reduced expenses throughout numerous services, company website benefiting the members straight.

Credit score unions commonly bill lower account maintenance fees, over-limit charges, and atm machine charges compared to business banks. In addition, they frequently use higher passion prices on financial savings accounts and lower passion rates on financings, leading to overall cost financial savings for their members. By maintaining costs and costs at a minimum, lending institution intend to provide monetary services that are accessible and economical, cultivating a more inclusive financial environment for people and communities.

Basically, choosing a cooperative credit union over a conventional bank can bring about substantial price financial savings gradually, making it a compelling alternative for those seeking a much more affordable strategy to banking solutions.

Community Involvement

With a strong focus on fostering close-knit relationships and supporting regional campaigns, lending institution proactively participate in community participation campaigns to equip and boost the locations they serve. Neighborhood participation is a keystone of credit rating unions' worths, reflecting their commitment to providing back and making a positive effect. Lending institution commonly take part in different community tasks such as volunteering, funding regional events, and offering economic education and learning programs.

By proactively taking part in community events and initiatives, credit score unions demonstrate their dedication to the well-being and prosperity of the communities they serve. This involvement surpasses simply financial purchases; it showcases a genuine rate of interest in developing solid, sustainable neighborhoods. Through collaborations with neighborhood companies and charities, cooperative credit union contribute to enhancing the lifestyle for citizens and fostering a sense of unity and support.

Additionally, these area participation efforts assist to create a positive picture for cooperative credit union, showcasing them as trusted and reputable companions invested in the success of their participants and the area at large. On the whole, community participation is a crucial element of cooperative credit union' procedures, reinforcing their dedication to social responsibility and community advancement.

Verdict

In final thought, lending institution offer various benefits such as autonomous control, better rate of interest, reduced financing rates, and minimized fees contrasted to for-profit financial institutions. With individualized consumer service, affordable rate of interest, lower costs, and a commitment to area participation, debt unions supply an one-of-a-kind worth recommendation for their participants. Stressing financial empowerment and community advancement, lending institution stand out as a beneficial option to traditional for-profit financial institutions.

Report this page